Advance Environmental Social & Governance

Transform ESG from Reporting Requirement to Strategic Value

ESG Excellence Creating Competitive Advantage & Stakeholder Value

Environmental Social and Governance measures how responsibly organisations use resources, treat stakeholders, and govern operations. This capability covers sustainability reporting, ethical practices, and stakeholder engagement. ESG performance directly impacts access to capital, regulatory compliance, and competitive positioning.

AI transforms ESG from compliance burden into strategic differentiator that creates measurable value.

Our strategic scenarios reveal how digibus.ai advisors guide you to transform ESG through real-time analytics, automated reporting, and intelligent monitoring—enabling you to significantly reduce environmental impact while ensuring compliance.

Ready to Turn ESG Compliance into Strategic Value?

Don't just meet ESG requirements—exceed them while creating competitive advantages. digibus.ai transforms ESG from reporting burden into a driver of innovation, efficiency, and stakeholder value.

ESG Excellence Impact:

Reduction in Environmental Impact: Through intelligent optimisation

Faster ESG Reporting: Automated accuracy and compliance

Improved ESG Ratings: Data-driven performance that stakeholders trust

Your Sustainability Advantage:

Real-time environmental monitoring and optimisation

Comprehensive supply chain sustainability visibility

Automated reporting that impresses stakeholders

Predictive analytics that drive continuous improvement

Make ESG your Competitive Differentiator

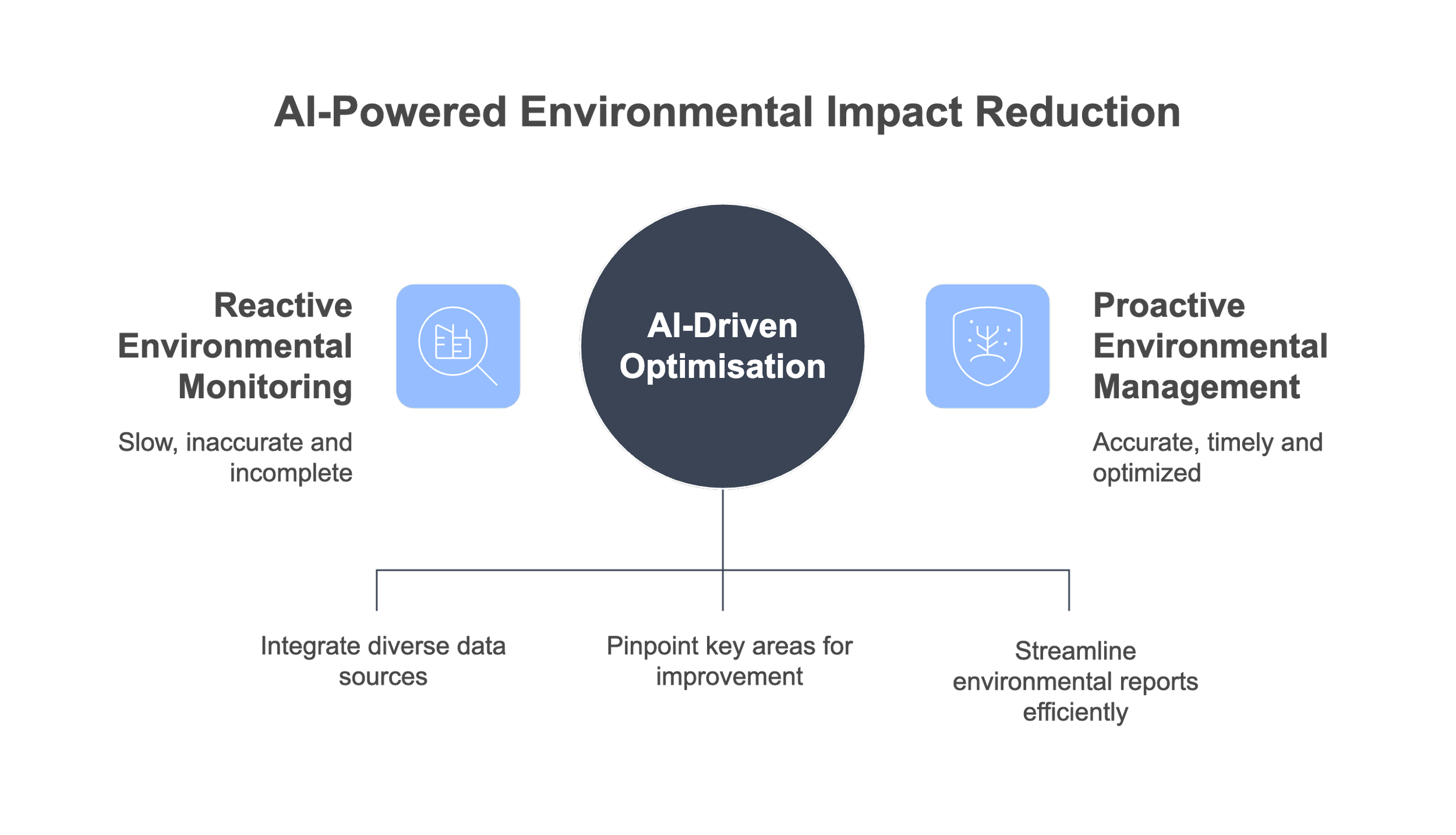

Real-time Carbon & Environmental Impact Analytics

AI-powered systems provide continuous monitoring and optimisation of carbon emissions, energy consumption, and environmental impact across all operations and supply chains.

CHALLENGE WITHOUT AI

Traditional environmental monitoring relies on quarterly data collection whilst organisations cannot respond quickly to environmental over-runs and miss optimisation opportunities.

AI SOLUTION OPPORTUNITY

Machine learning models integrate data from IoT sensors whilst AI algorithms identify emission hotspots and predict environmental impacts automatically.

IMPACTED CAPABILITIES

Environmental Sustainability Management, Regulatory Reporting, Operations Management, Procurement and Supply Chain Management, Strategic Planning capabilities are enhanced through intelligent monitoring.

TANGIBLE BUSINESS BENEFITS

Emission reduction: Reduction in energy consumption and emissions through AI-driven optimisation whilst real-time visibility enables immediate response to environmental incidents.

Cost optimisation: Automated reporting reduces compliance costs whilst improving data accuracy and stakeholder confidence through enhanced environmental monitoring.

Financing access: Companies report significant improvements in ESG ratings whilst access to sustainable financing options improves through better environmental performance.

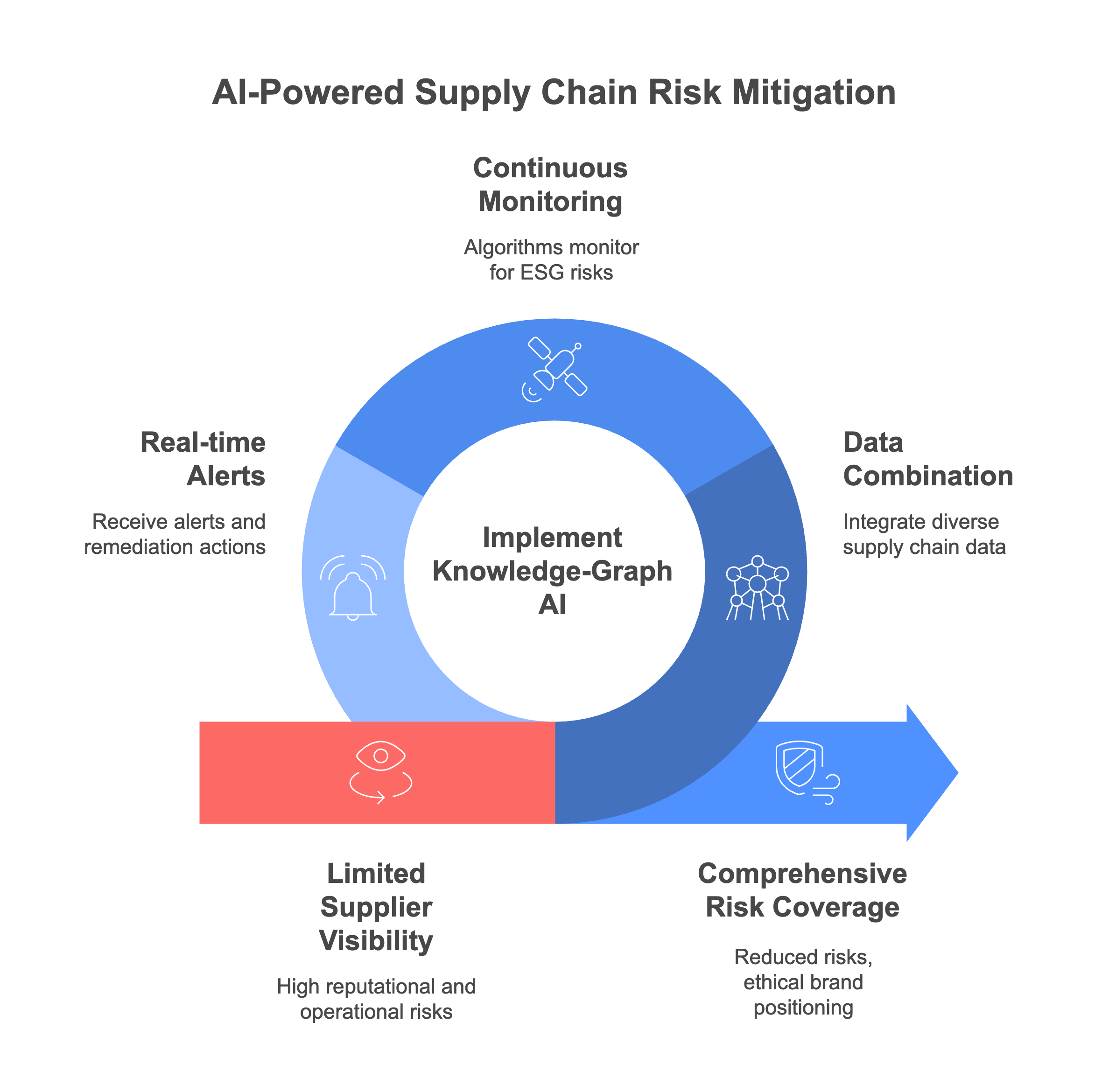

AI-Powered Supply Chain Sustainability Monitoring

Advanced analytics and satellite imagery provide comprehensive visibility into supplier ESG performance beyond traditional relationships, enabling proactive risk management and ethical sourcing.

CHALLENGE WITHOUT AI

Traditional supply chain monitoring covers limited suppliers whilst manual auditing is expensive and often fails to detect emerging risks.

AI SOLUTION OPPORTUNITY

Knowledge-graph AI combines trade data whilst machine learning algorithms continuously monitor for deforestation and environmental breaches automatically.

IMPACTED CAPABILITIES

Sustainable Procurement, Vendor Risk Management, Brand Management, Regulatory Compliance, Crisis Management capabilities are enhanced through comprehensive supply chain monitoring.

TANGIBLE BUSINESS BENEFITS

Risk coverage: Supplier risk coverage compared to traditional methods whilst early warning systems prevent supply chain disruptions and brand damage incidents.

Brand protection: Companies report stronger ethical brand positioning whilst improved customer loyalty and enhanced access to ESG-conscious markets.

Reputation management: Reduced reputational risks through proactive monitoring whilst enhanced stakeholder confidence improves business relationships and market positioning.

Automated ESG Reporting & Regulatory Compliance

Large language models and automated data integration systems transform ESG reporting from a lengthy manual process into a continuous, accurate capability.

CHALLENGE WITHOUT AI

ESG reporting preparation typically takes extensive time whilst organisations struggle to maintain audit trails and update reports as regulations change.

AI SOLUTION OPPORTUNITY

Large language models automatically ingest structured data whilst AI systems monitor regulatory changes and automatically update reporting templates.

IMPACTED CAPABILITIES

Regulatory Reporting, Data Management, Audit and Assurance, Stakeholder Communications, Governance capabilities are enhanced through automated reporting systems.

TANGIBLE BUSINESS BENEFITS

Reporting efficiency: Report preparation time decreases significantly whilst audit costs reduce and near real-time ESG performance visibility builds investor confidence.

Compliance maintenance: Organisations maintain compliance with evolving regulations whilst reducing manual effort and improving data quality and consistency.

Stakeholder confidence: Enhanced ESG ratings and improved stakeholder relationships through accurate, timely reporting and transparent performance measurement.

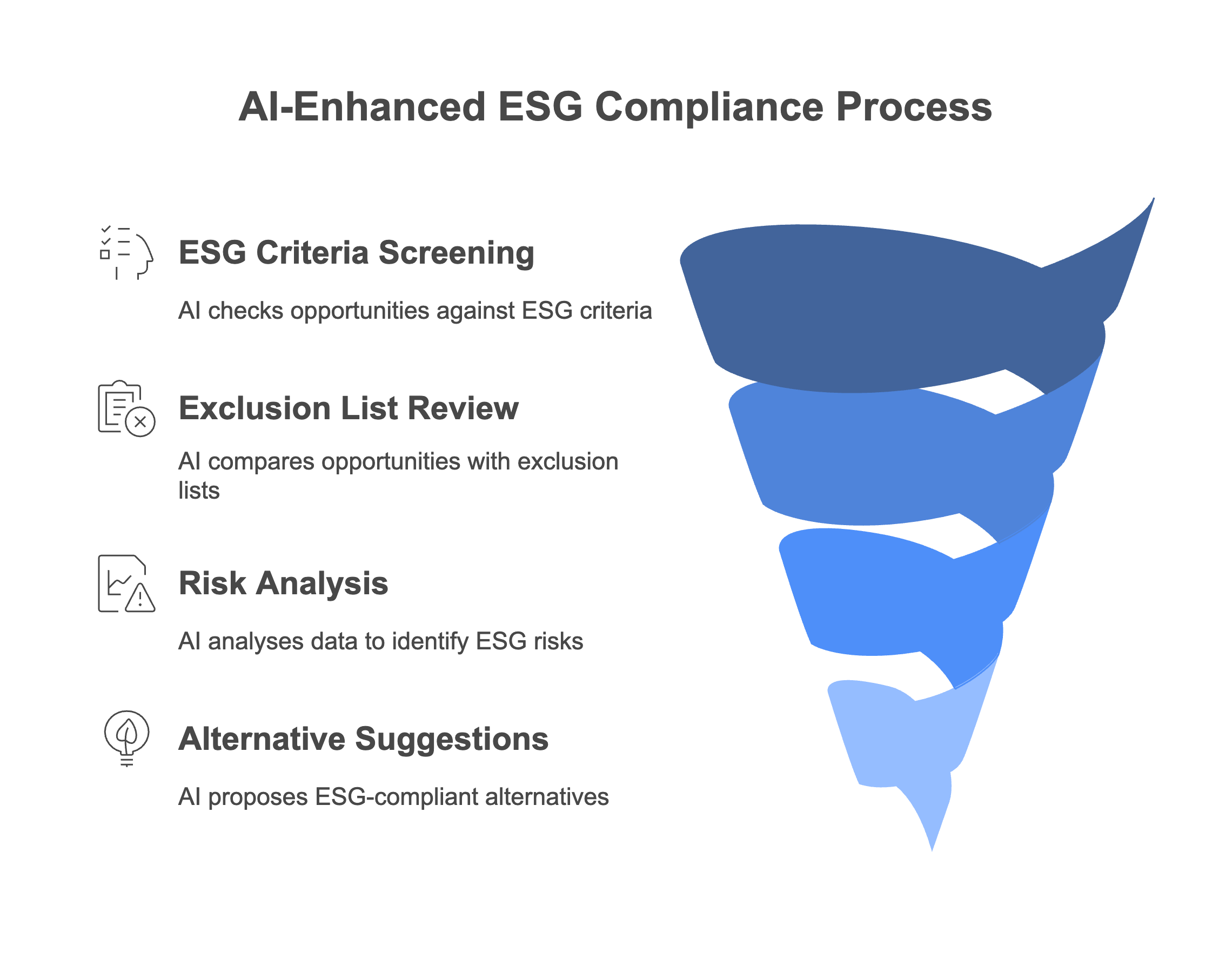

Intelligent Responsible Investment & Procurement Screening

Natural language processing and machine learning automatically screen investment opportunities, vendors, and business partners against ESG criteria before approval.

CHALLENGE WITHOUT AI

Manual due diligence processes often miss ESG violations whilst traditional screening methods are time-consuming and struggle with changing requirements.

AI SOLUTION OPPORTUNITY

AI systems automatically match transactions to comprehensive ESG taxonomies whilst machine learning algorithms analyse financial data and regulatory filings automatically.

IMPACTED CAPABILITIES

Investment Management, Procurement Policy, Risk Management, Treasury Operations, Regulatory Compliance capabilities are enhanced through automated ESG screening.

TANGIBLE BUSINESS BENEFITS

Compliance prevention: Organisations prevent non-compliant spending before occurrence whilst procurement cycle times improve whilst maintaining rigorous ESG standards.

Access protection: Companies demonstrate proactive ESG governance whilst maintaining access to ESG-focused capital markets and business opportunities.

Risk mitigation: Reduced regulatory penalties whilst enhanced stakeholder confidence improves business relationships and competitive positioning.

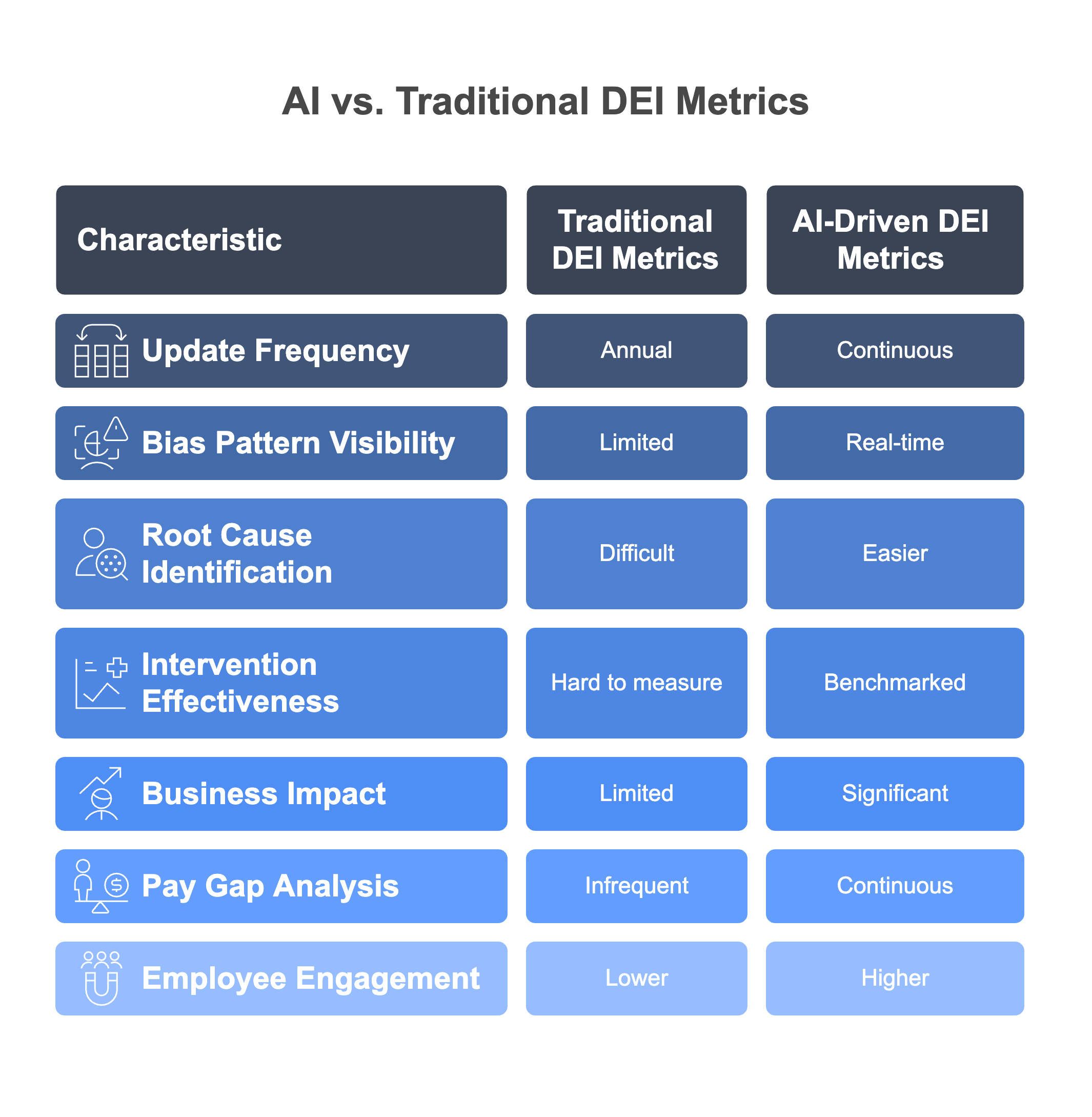

AI-Enhanced Diversity, Equity & Inclusion Analytics

Machine learning algorithms provide continuous analysis of workforce diversity, equity, and inclusion metrics, identifying bias patterns and recommending targeted interventions.

CHALLENGE WITHOUT AI

Traditional DEI metrics update annually whilst organisations struggle to identify root causes of diversity challenges and measure intervention effectiveness.

AI SOLUTION OPPORTUNITY

Machine learning algorithms continuously analyse hiring data whilst AI systems benchmark performance against diversity goals and highlight successful interventions.

IMPACTED CAPABILITIES

Human Resources Management, Talent Acquisition, Performance Management, Leadership Development, Organisational Culture capabilities are enhanced through continuous DEI monitoring.

TANGIBLE BUSINESS BENEFITS

Progress visibility: Quarterly visibility into DEI progress whilst pay gap analysis and bias detection improve compensation equity and reduce legal risks.

Performance improvement: Enhanced diversity and inclusion lead to improved employee engagement whilst strengthening employer brand and market competitiveness.

Organisational outcomes: Better alignment between diversity goals and business outcomes whilst measurable improvements in innovation and market performance.

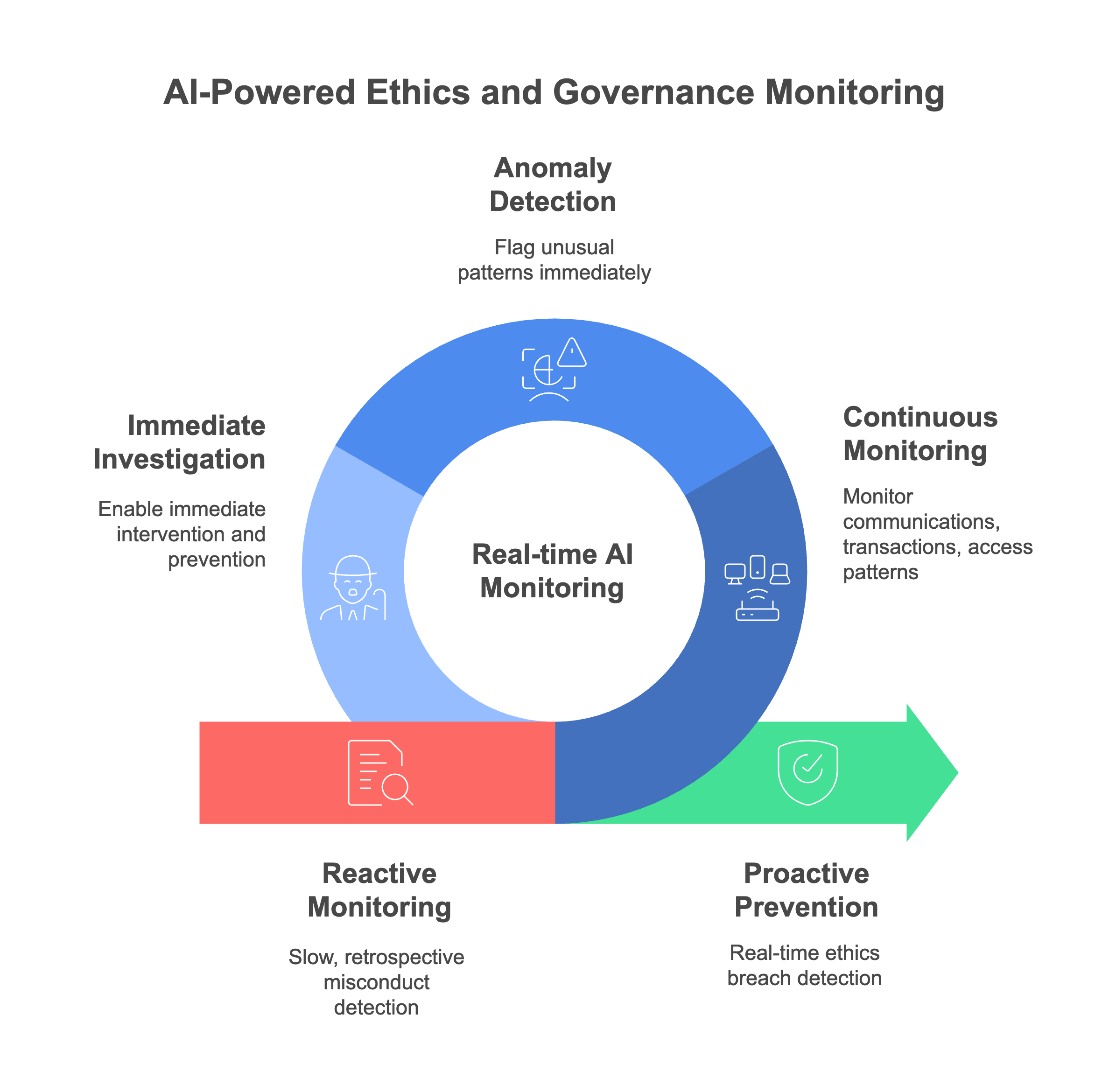

Real-time Ethics & Governance Risk Detection

Advanced analytics monitor communications, transactions, and access patterns to detect potential ethics violations, fraud, and governance breaches in real-time.

CHALLENGE WITHOUT AI

Traditional ethics monitoring relies on retrospective audits whilst organisations cannot prevent governance breaches before they cause significant damage.

AI SOLUTION OPPORTUNITY

Unsupervised machine learning and natural language processing continuously monitor communications whilst anomaly detection algorithms flag unusual patterns automatically.

IMPACTED CAPABILITIES

Corporate Governance, Risk Management, Internal Audit, Legal Compliance, Crisis Management capabilities are enhanced through real-time monitoring and detection.

TANGIBLE BUSINESS BENEFITS

Detection acceleration: Faster detection of governance breaches whilst proactive monitoring prevents minor issues from escalating into major crises.

Reputation protection: Companies demonstrate robust governance frameworks whilst improving access to capital and market opportunities through enhanced compliance.

Risk prevention: Reduced potential damage and remediation costs whilst stronger stakeholder relationships improve business sustainability and competitive positioning.