Transform Financial Services

AI-Powered Innovation for Enhanced Customer Outcomes

Intelligent Finance: AI-Driven Customer Outcomes and Operational Excellence

Australia's financial services sector manages over $3.5 trillion in superannuation assets while facing regulatory pressures and fintech disruption. AI enables personalised customer experiences, operational automation, and enhanced investment performance across diverse financial products. Leading institutions achieve 25-40% customer retention improvements and 30-50% operational cost reductions through intelligent systems. Organisations must implement AI across customer engagement, advisory services, risk management and strategic planning to maintain competitive advantage and deliver superior stakeholder outcomes.

The following six high-impact AI scenarios demonstrate how digibus.ai can help financial institutions realise these transformative benefits:

Ready to Exceed Customer Expectations while Driving Operational Excellence?

In Australia's competitive financial landscape, success demands more than traditional approaches. digibus.ai helps financial institutions harness AI to deliver personalised customer experiences, optimise operations, and manage risk while achieving remarkable results: improvement in customer retention, reduction in operational costs, and enhanced investment performance through intelligent analytics.

We understand the financial services ecosystem – from regulatory requirements and fiduciary responsibilities to customer expectations and competitive pressures. Our AI solutions are built for financial environments, ensuring compliance while delivering innovation that drives growth.

Why financial leaders choose digibus.ai:

Financial services expertise with deep regulatory knowledge

AI solutions designed for banking, superannuation, and advisory services

Proven methodology delivering measurable ROI

Comprehensive support from strategy to implementation

Become an AI-Powered Leader Excelling in Customer Service, Operational Efficiency and Sustainable Profitability

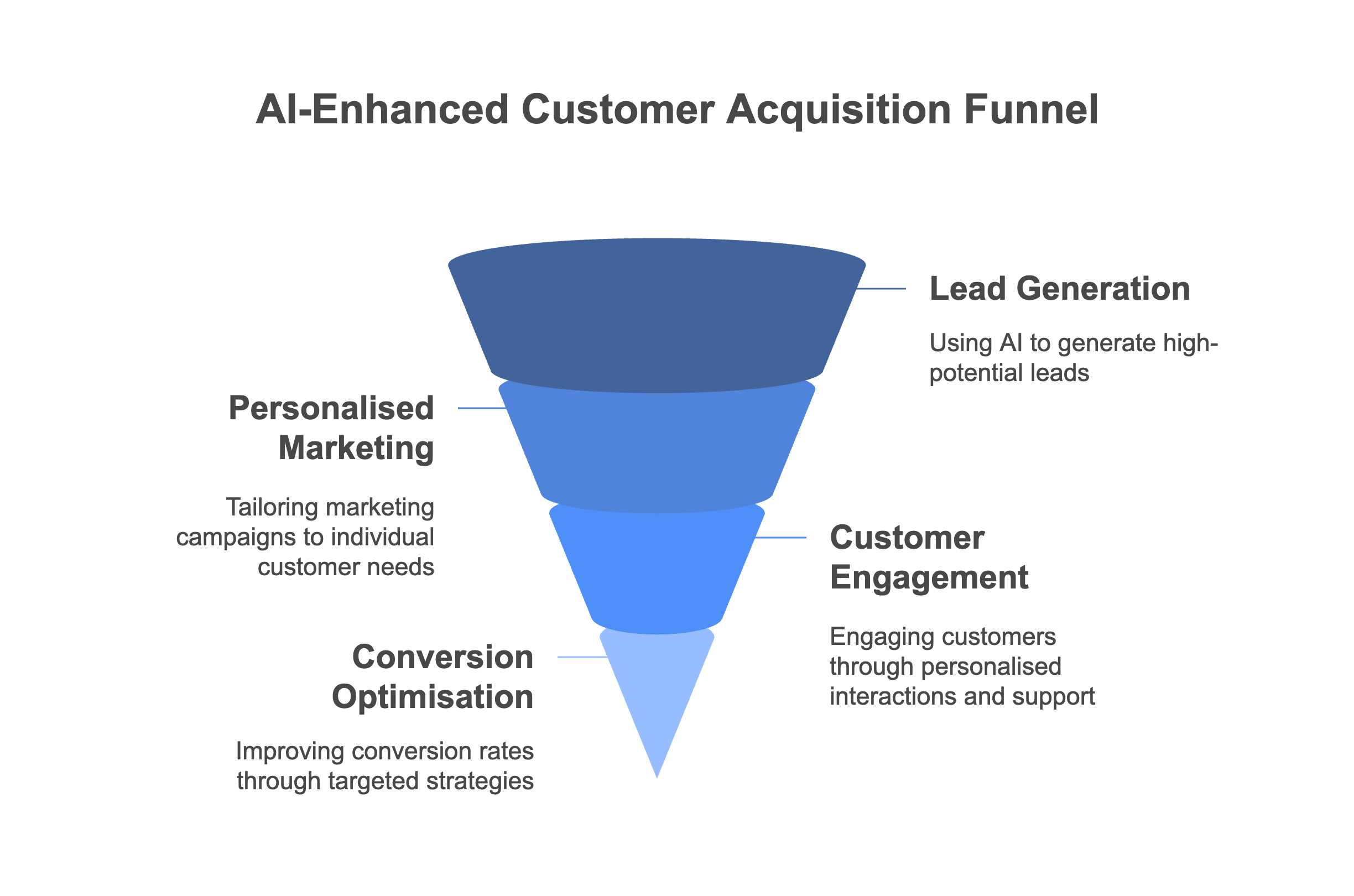

AI-Enhanced Customer Acquisition & Personalised Engagement

AI-powered customer relationship management systems optimising lead generation, personalising marketing campaigns, and predicting customer lifetime value to enhance acquisition and retention across diverse financial services.

CHALLENGE WITHOUT AI

Traditional marketing approaches cannot effectively segment diverse customer populations whilst manual customer acquisition processes lack sophistication needed to identify high-value prospects.

AI SOLUTION OPPORTUNITY

Deploy machine learning algorithms analysing customer data, behavioural patterns, and market intelligence identifying high-potential prospects whilst AI-powered recommendation engines deliver personalised product suggestions.

IMPACTED CAPABILITIES

Customer relationship management and engagement, marketing and lead generation, sales process optimisation, customer segmentation and analytics, digital channel management, customer service, brand management

TANGIBLE BUSINESS BENEFITS

Customer acquisition: Increase in conversion rates through targeted marketing and personalised engagement strategies whilst customer lifetime value optimisation identifies high-potential relationships.

Cost optimisation: Reduction in customer acquisition costs through improved targeting and automated processes whilst marketing efficiency gains include improvement in campaign effectiveness.

Marketing efficiency: Improvement in campaign effectiveness and return on marketing investment whilst customer satisfaction enhancement results from personalised experiences.

Customer satisfaction: Personalised experiences and responsive service delivery improving Net Promoter Scores and brand loyalty whilst revenue growth includes cross-selling opportunities.

Revenue growth: Cross-selling and upselling opportunities increase customer wallet share whilst improved retention rates preserve existing revenue streams and reduce churn-related losses.

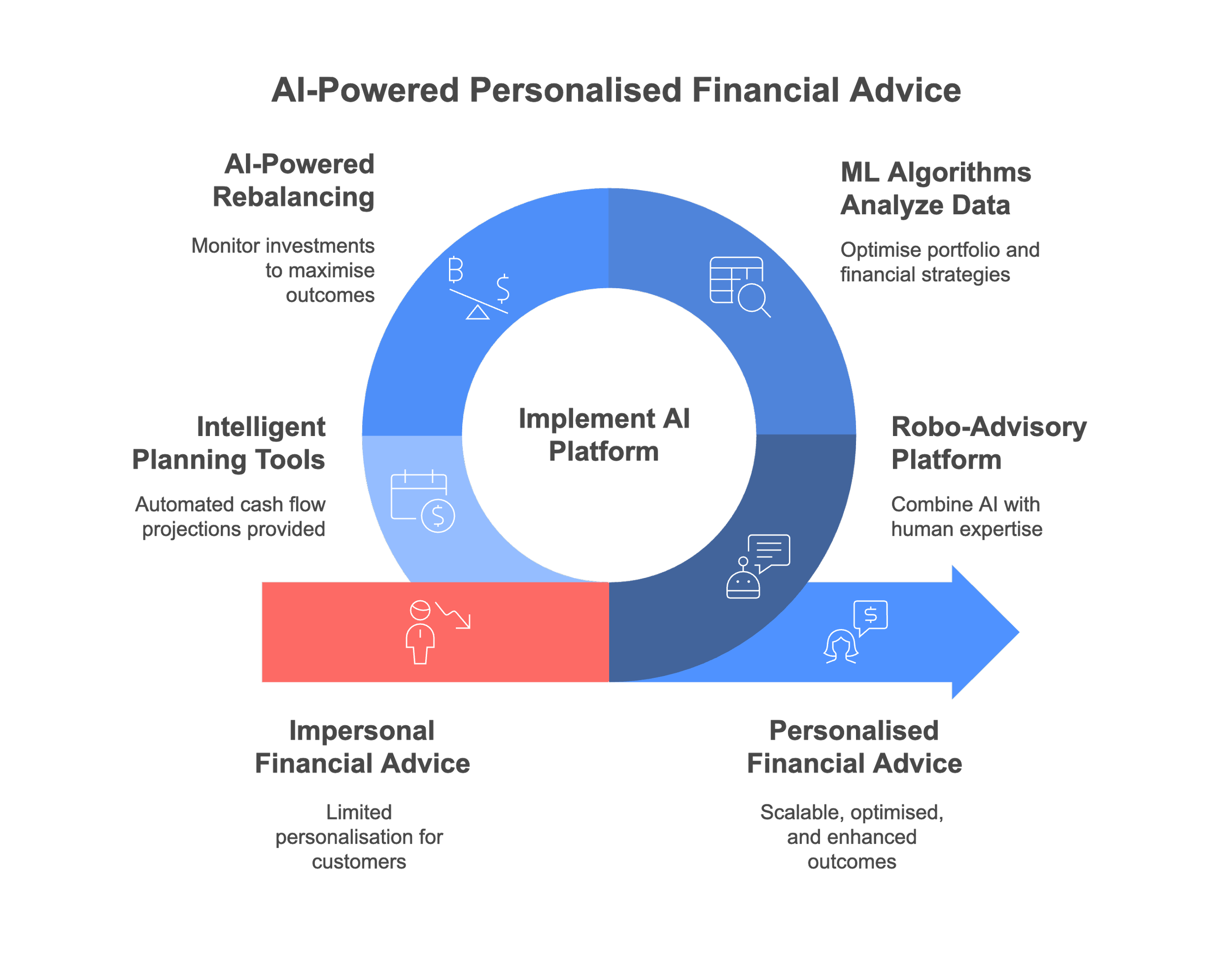

Hyper-Personalised Financial Advice and Wealth Management

AI-augmented advisory platforms delivering scalable personalised financial advice, optimising portfolio management, and enhancing client outcomes through intelligent investment recommendations and automated financial planning.

CHALLENGE WITHOUT AI

Traditional advisory models cannot cost-effectively deliver personalised advice to mass market customers whilst manual portfolio management processes cannot scale to serve large bases.

AI SOLUTION OPPORTUNITY

Implement robo-advisory platforms combining artificial intelligence with human expertise delivering personalised investment advice whilst machine learning algorithms analyse individual financial situations.

IMPACTED CAPABILITIES

Investment advisory and wealth management, financial planning and goal setting, portfolio construction and optimisation, risk assessment and management, regulatory compliance, client communication, technology platform development.

TANGIBLE BUSINESS BENEFITS

Business scalability: Advisory services for significantly more clients per advisor through AI-augmented advice delivery expanding market reach and revenue potential.

Cost efficiency: Reduction in advice delivery costs through automation and process optimisation whilst client outcomes improvement includes enhancement in portfolio performance.

Client outcomes: Enhancement in portfolio performance through AI-driven optimisation and systematic rebalancing whilst market expansion provides access to mass market segments.

Market expansion: Access to mass market segments previously uneconomical to serve creating new revenue streams whilst operational excellence delivers consistent advice quality.

Competitive differentiation: Innovative service delivery models attract tech-savvy customers and enhance market positioning whilst consistent advice quality ensures regulatory compliance.

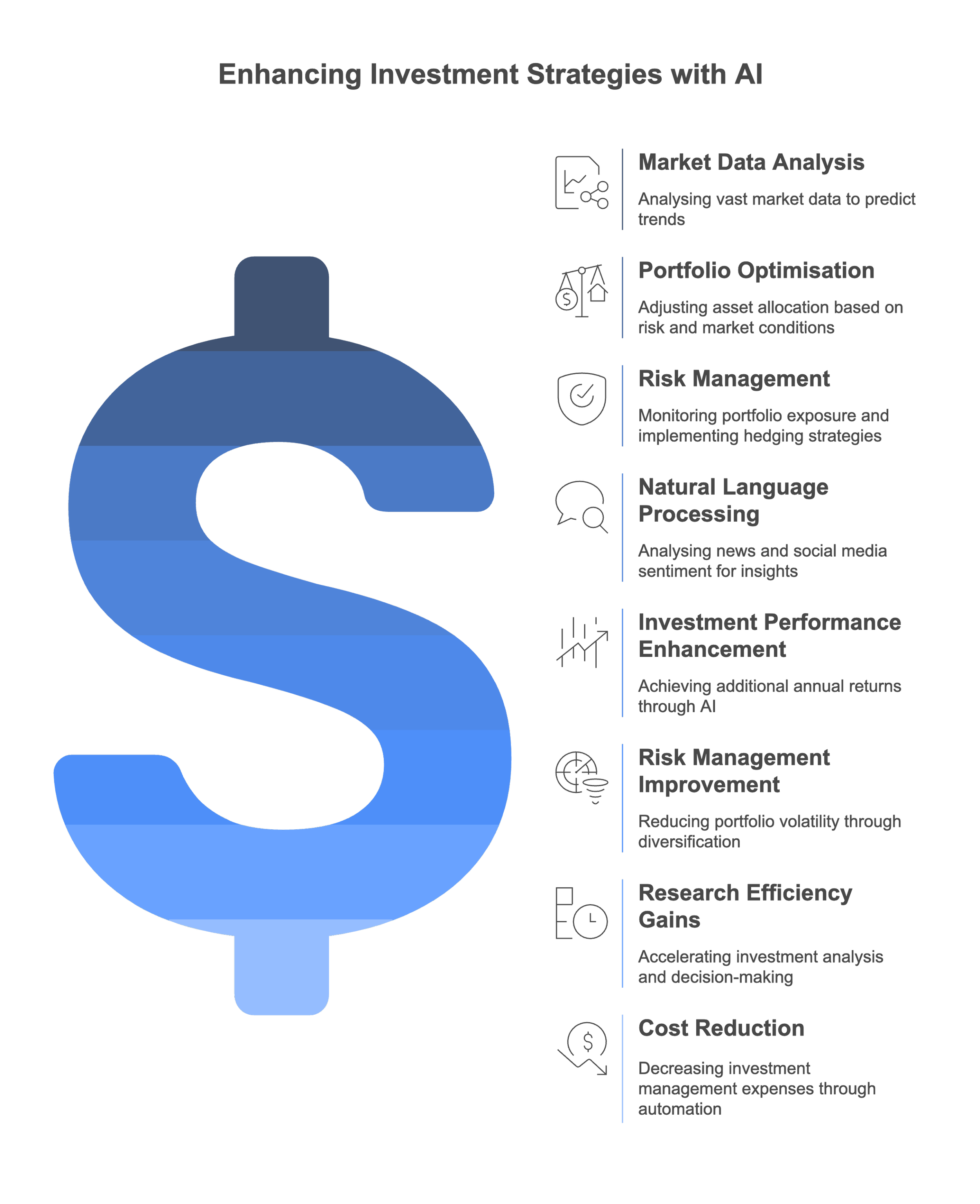

Predictive Investment Analytics and Portfolio Optimisation

AI-driven investment platforms analysing market data, predicting trends, and optimising portfolio allocation strategies to enhance investment performance and risk management across superannuation and investment products.

CHALLENGE WITHOUT AI

Traditional investment analysis methods cannot effectively process vast amounts of market data whilst manual research processes are time-consuming and subject to biases.

AI SOLUTION OPPORTUNITY

Deploy advanced machine learning models analysing market data, economic indicators, and alternative data sources identifying investment opportunities whilst AI-powered portfolio optimisation systems automatically adjust allocation.

IMPACTED CAPABILITIES

Investment research and analysis, portfolio management and optimisation, risk management and hedging, performance measurement and attribution, market research and intelligence, quantitative analytics, investment committee support.

TANGIBLE BUSINESS BENEFITS

Investment performance: Additional annual returns through AI-driven analysis and optimisation representing significant value creation for superannuation members and investment clients.

Risk management: Reduction in portfolio volatility through intelligent diversification and hedging strategies whilst research efficiency gains deliver acceleration in investment analysis.

Research efficiency: Acceleration in investment analysis and decision-making processes whilst cost reduction achieves decrease in investment management expenses.

Cost reduction: Decrease in investment management expenses through automated processes and improved operational efficiency whilst competitive advantage results from superior investment outcomes.

Member satisfaction: Superannuation funds experience reduced member switching and increased voluntary contributions whilst superior investment outcomes attract additional assets under management.

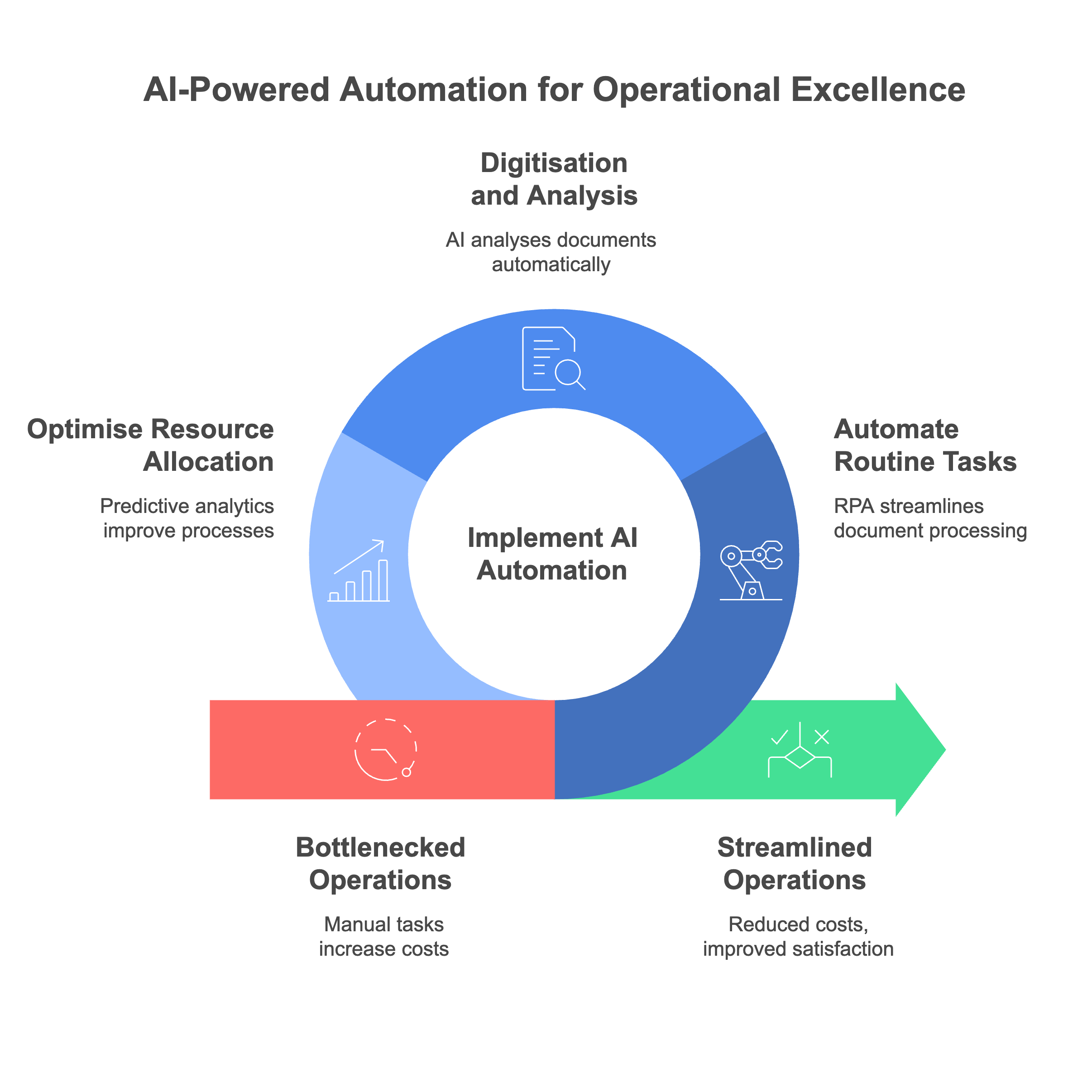

Intelligent Process Automation and Operational Excellence

AI-powered automation systems streamlining back-office operations, accelerating transaction processing, and enhancing operational efficiency across claims processing, underwriting, and administrative functions comprehensively.

CHALLENGE WITHOUT AI

Manual processing of applications, claims, and administrative tasks creates operational bottlenecks whilst paper-based systems require significant manual intervention creating processing delays.

AI SOLUTION OPPORTUNITY

Implement robotic process automation enhanced with machine learning capabilities automating routine tasks whilst AI-powered optical character recognition and natural language processing systems digitise documents.

IMPACTED CAPABILITIES

Operations and transaction processing, document management and digitisation, quality control and compliance monitoring, workforce management, customer service, regulatory reporting, technology integration.

TANGIBLE BUSINESS BENEFITS

Operational efficiency: Reduction in processing times for applications, claims, and routine transactions enhancing customer experience whilst cost reduction delivers decrease in operational processing costs.

Cost reduction: Decrease in operational processing costs through automation and elimination of manual tasks whilst accuracy enhancement includes reduction in processing errors.

Accuracy enhancement: Reduction in processing errors through automated validation and quality control systems whilst scalability benefits enable processing volume increases substantially.

Scalability: Processing volume increases without proportional staff increases whilst compliance improvement includes automated regulatory reporting and audit trail capabilities.

Customer satisfaction: Faster processing times and improved service quality leading to improved retention and referral rates whilst compliance improvement reduces regulatory risks.

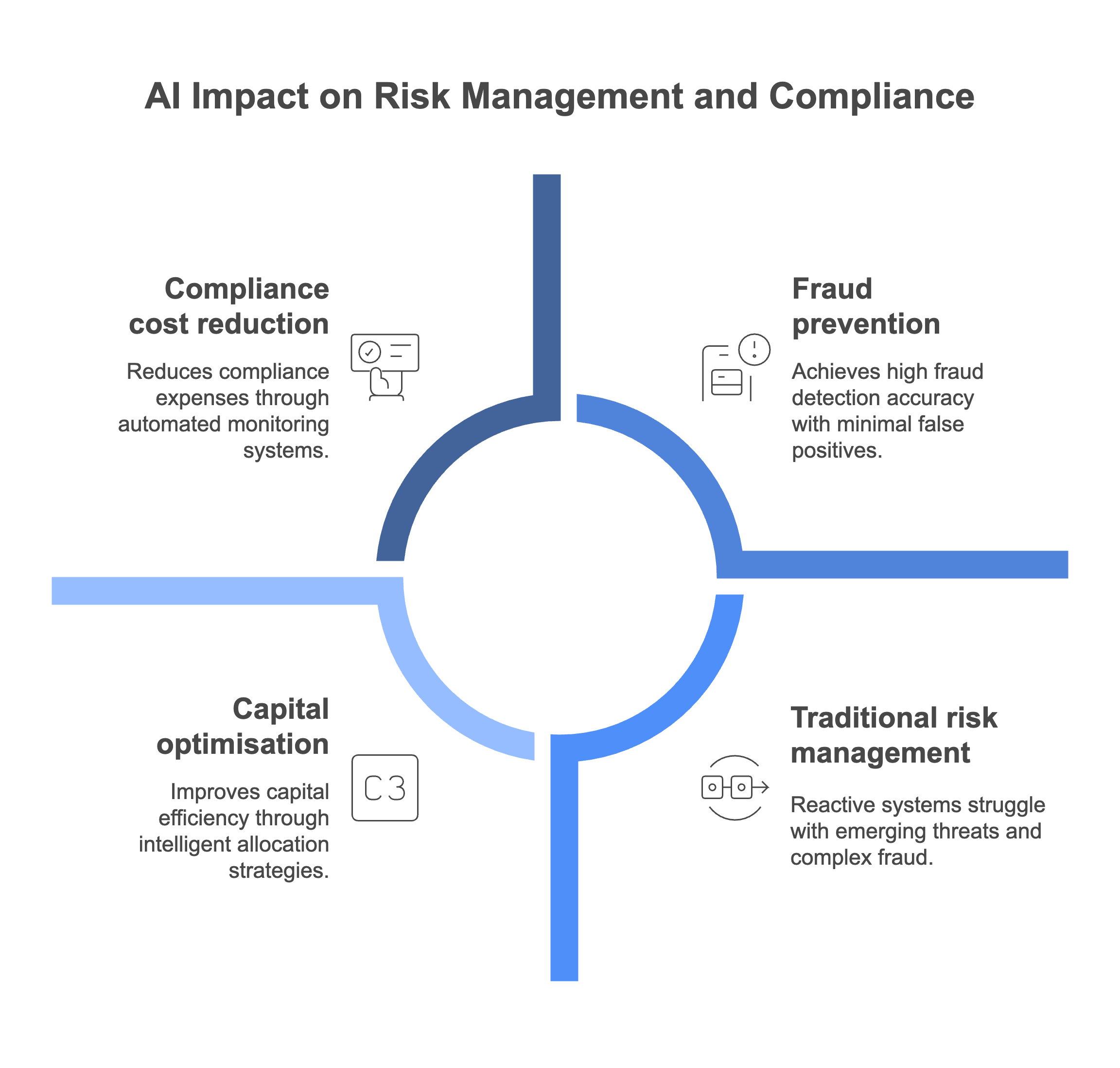

Proactive Risk Management and Regulatory Compliance

AI-enhanced risk monitoring systems predicting and preventing fraud, ensuring regulatory compliance, and optimising capital allocation through intelligent risk assessment and management across business lines.

CHALLENGE WITHOUT AI

Traditional risk management systems are reactive and cannot effectively identify emerging threats whilst manual compliance monitoring processes are resource-intensive.

AI SOLUTION OPPORTUNITY

Deploy machine learning models continuously monitoring transaction patterns, customer behaviour, and market conditions identifying fraud whilst AI-powered regulatory compliance systems automatically track changes.

IMPACTED CAPABILITIES

Risk assessment and monitoring, fraud detection and prevention, regulatory compliance and reporting, capital management and allocation, credit risk analysis, operational risk management, crisis management.

TANGIBLE BUSINESS BENEFITS

Fraud prevention: Improvement in fraud detection accuracy whilst reducing false positives protecting institutional assets and customer funds effectively.

Compliance cost: Decrease in regulatory compliance expenses through automated monitoring and reporting systems whilst risk management enhancement includes early identification.

Risk management: Early identification of emerging risks prevents potential losses whilst capital optimisation achieves improvement in capital efficiency through intelligent allocation.

Capital optimisation: Improvement in capital efficiency through intelligent allocation and regulatory capital management whilst regulatory reputation protection prevents costly penalties.

Operational resilience: Faster response to risk events and enhanced business continuity planning whilst regulatory reputation protection prevents regulatory action.

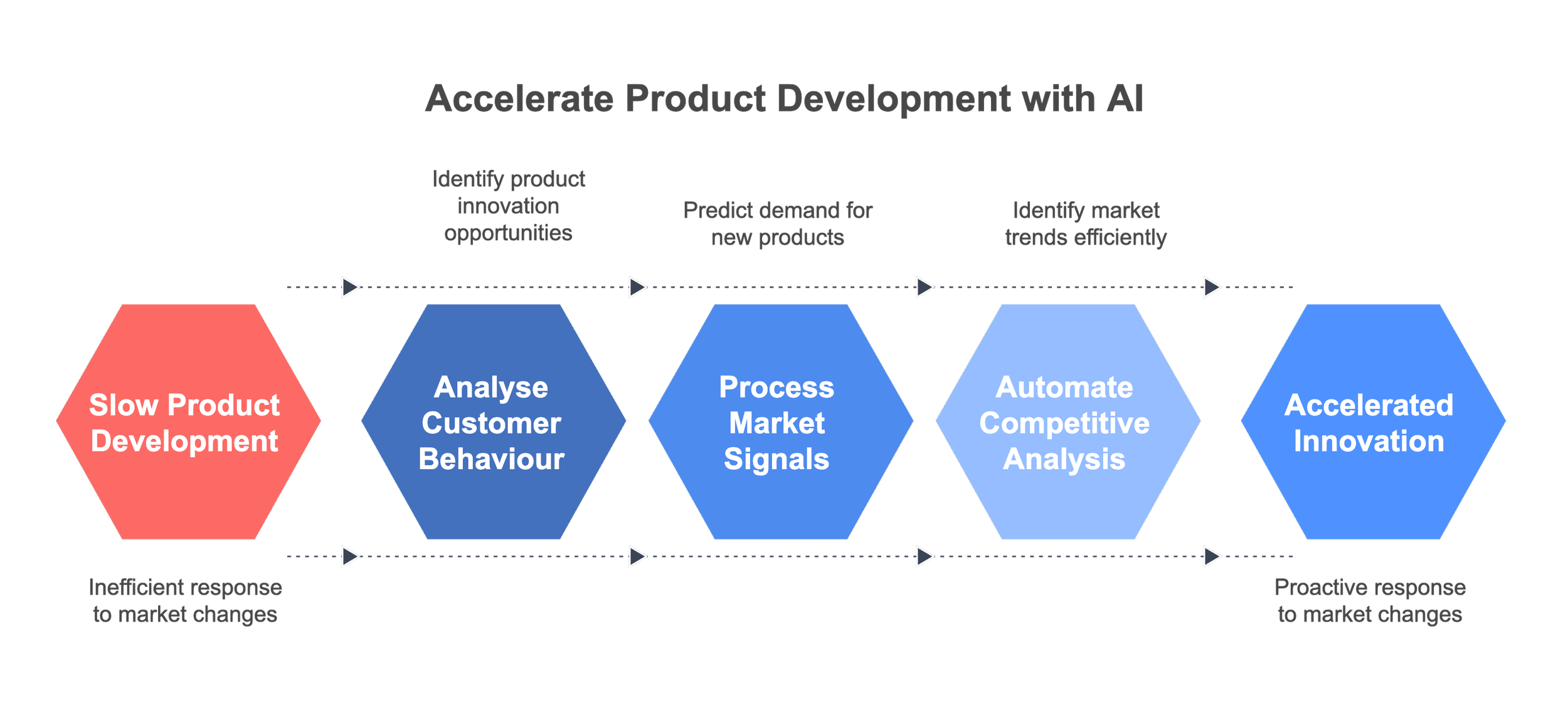

AI-Driven Product Innovation and Market Intelligence

AI-powered innovation platforms analysing market trends, customer needs, and competitive dynamics to accelerate product development and identify new business opportunities in financial services markets.

CHALLENGE WITHOUT AI

Traditional product development processes are slow and cannot effectively respond to rapidly changing customer needs whilst limited ability to analyse customer feedback prevents innovation.

AI SOLUTION OPPORTUNITY

Implement advanced analytics platforms analysing customer behaviour, market trends, and competitive intelligence identifying product innovation opportunities whilst machine learning algorithms process customer feedback.

IMPACTED CAPABILITIES

Product development and innovation, market research and competitive intelligence, customer insights and analytics, pricing strategy and optimisation, go-to-market planning, strategic planning, partnership evaluation.

TANGIBLE BUSINESS BENEFITS

Innovation acceleration: Reduction in product development timelines through AI-enhanced market research whilst revenue growth includes identification of new market opportunities.

Revenue growth: Identification of new market opportunities in additional revenue potential whilst market intelligence enhancement provides competitive advantage through superior understanding.

Market intelligence: Competitive advantage through superior understanding of market trends whilst product optimisation delivers improvement in product adoption rates.

Product optimisation: Improvement in product adoption rates through better market fit whilst cost efficiency gains include reduction in market research costs.

Strategic positioning: Proactive response to market changes and competitive threats maintaining market leadership whilst cost efficiency gains include reduction in development costs.