Elevate Finance Operations

Turn Finance into Your Strategic Growth Engine

Real-Time Financial Intelligence That Drives Strategic Growth

Finance manages organisational resources, provides strategic insights, and ensures fiscal responsibility. This capability spans planning, reporting, risk management, and decision support. Modern finance must deliver real-time insights while maintaining compliance and controlling costs.

AI transforms finance from historical reporting into predictive intelligence that guides strategic decisions and accelerates growth.

Our comprehensive scenarios show how digibus.ai works with you to transform finance through predictive forecasting, automated processing, and real-time analytics—enabling you to significantly improve accuracy while drastically cutting costs.

Ready to Turn Finance into a Strategic Growth Engine?

Stop drowning in spreadsheets and manual processes. digibus.ai transforms your finance function into a real-time intelligence centre that drives strategic decisions and accelerates business growth.

Financial Transformation Results?

Faster Reporting: From days to hours

More Accurate Forecasting: Predictions you can bank on

Reduction in Processing Costs: Automation that pays for itself

Your Strategic Finance Advantage:

Real-time dashboards that reveal opportunities instantly

Predictive analytics that keep you ahead of risks

Automated processes that eliminate manual errors

Strategic insights that guide executive decisions

Make Finance your Competitive Advantage

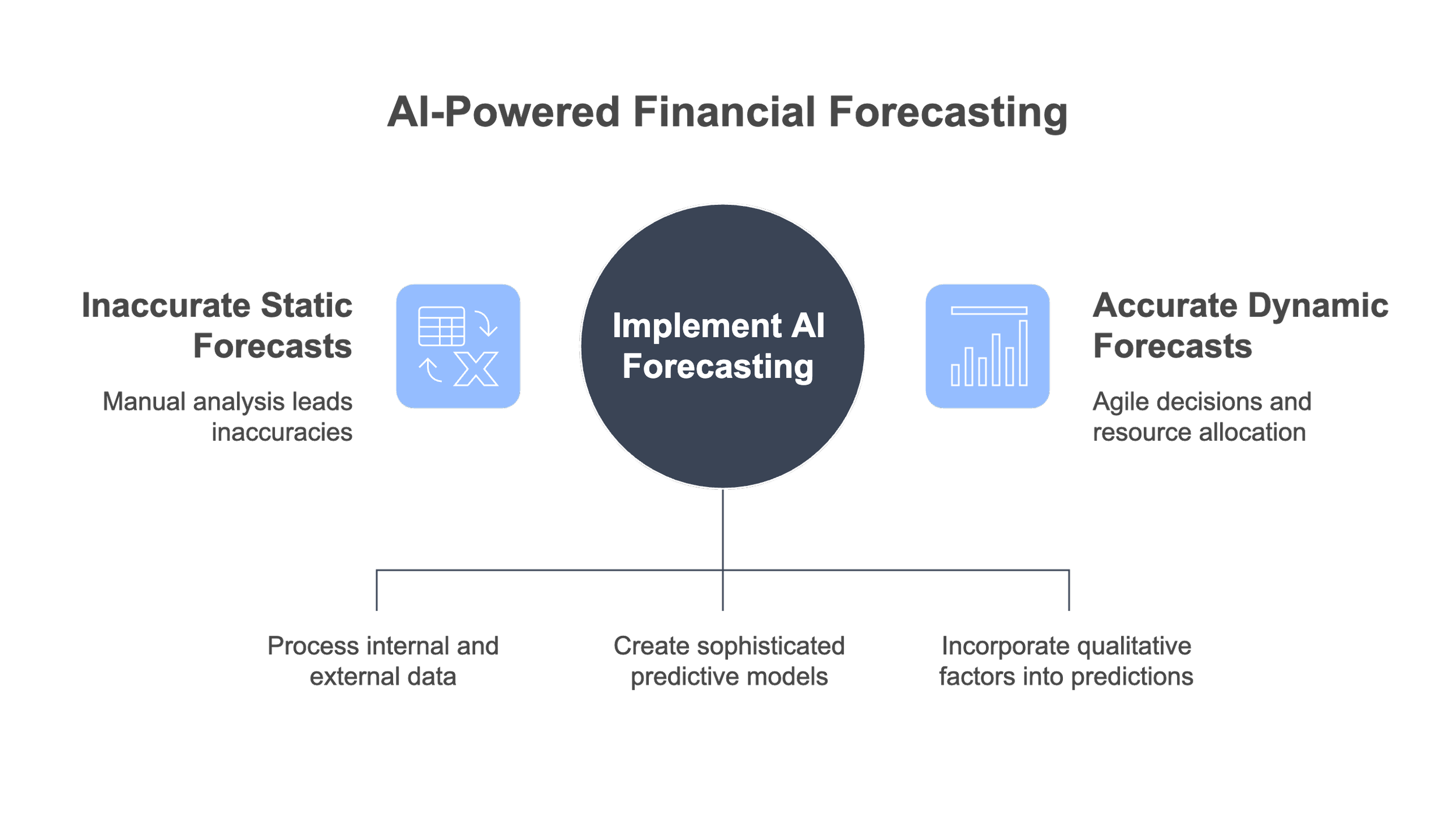

Predictive Financial Forecasting and Planning

AI-powered forecasting models analyse historical data, market trends, and external economic indicators to generate dynamic, accurate financial predictions that adapt to changing business conditions in real-time.

CHALLENGE WITHOUT AI

Traditional financial forecasting relies heavily on spreadsheet-based models and manual analysis, resulting in static forecasts that quickly become outdated whilst finance teams spend weeks compiling data.

AI SOLUTION OPPORTUNITY

Machine learning algorithms process vast amounts of internal financial data alongside external market indicators to create sophisticated predictive models that continuously learn from new data inputs.

IMPACTED CAPABILITIES

Financial Planning and Analysis, Strategic Planning, Treasury Management, Budget Management, Performance Management, Business Intelligence and Reporting capabilities are enhanced through predictive analytics.

TANGIBLE BUSINESS BENEFITS

Forecast accuracy: Improvement in forecast accuracy and reduction in planning cycle times whilst CFOs gain ability to update forecasts more frequently than quarterly cycles.

Cash flow management: Better working capital management through more accurate cash flow predictions, resulting in optimised inventory levels and reduced financing costs.

Strategic planning: Strategic planning becomes more robust with scenario modelling capabilities that rapidly assess financial impact of different business strategies or market conditions.

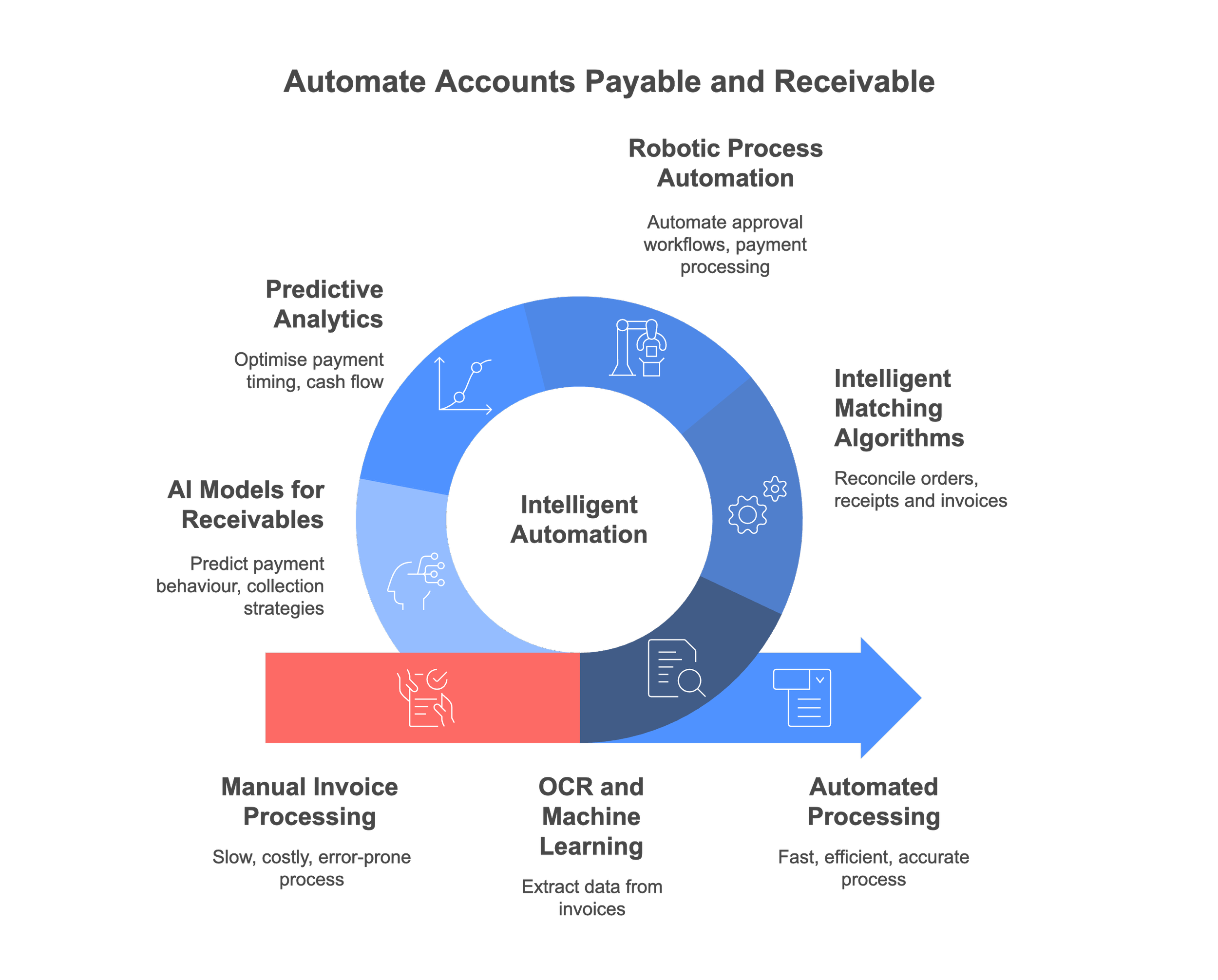

Automated Accounts Payable and Receivable Processing

Intelligent automation systems handle end-to-end invoice processing, payment approvals, and collections management with minimal human intervention, dramatically reducing processing costs and cycle times.

CHALLENGE WITHOUT AI

Manual invoice processing creates significant operational bottlenecks whilst error rates remain high due to manual data entry, leading to duplicate payments and missed discounts.

AI SOLUTION OPPORTUNITY

Optical Character Recognition combined with machine learning automatically extracts data from invoices whilst intelligent matching algorithms reconcile purchase orders and receipts with high accuracy.

IMPACTED CAPABILITIES

Accounts Payable Management, Accounts Receivable Management, Cash Management, Vendor Management, Credit Management, Financial Operations capabilities are enhanced through intelligent automation.

TANGIBLE BUSINESS BENEFITS

Processing efficiency: Reduction in invoice processing costs and faster processing times whilst straight-through processing rates exceed expectations for standard invoices.

Cash flow improvement: Days Sales Outstanding improves significantly, improving cash flow and working capital efficiency whilst reduction in duplicate payments and increased early payment discounts.

Resource optimisation: Finance staff freed for value-added activities whilst operational costs decrease through automated processes and improved accuracy.

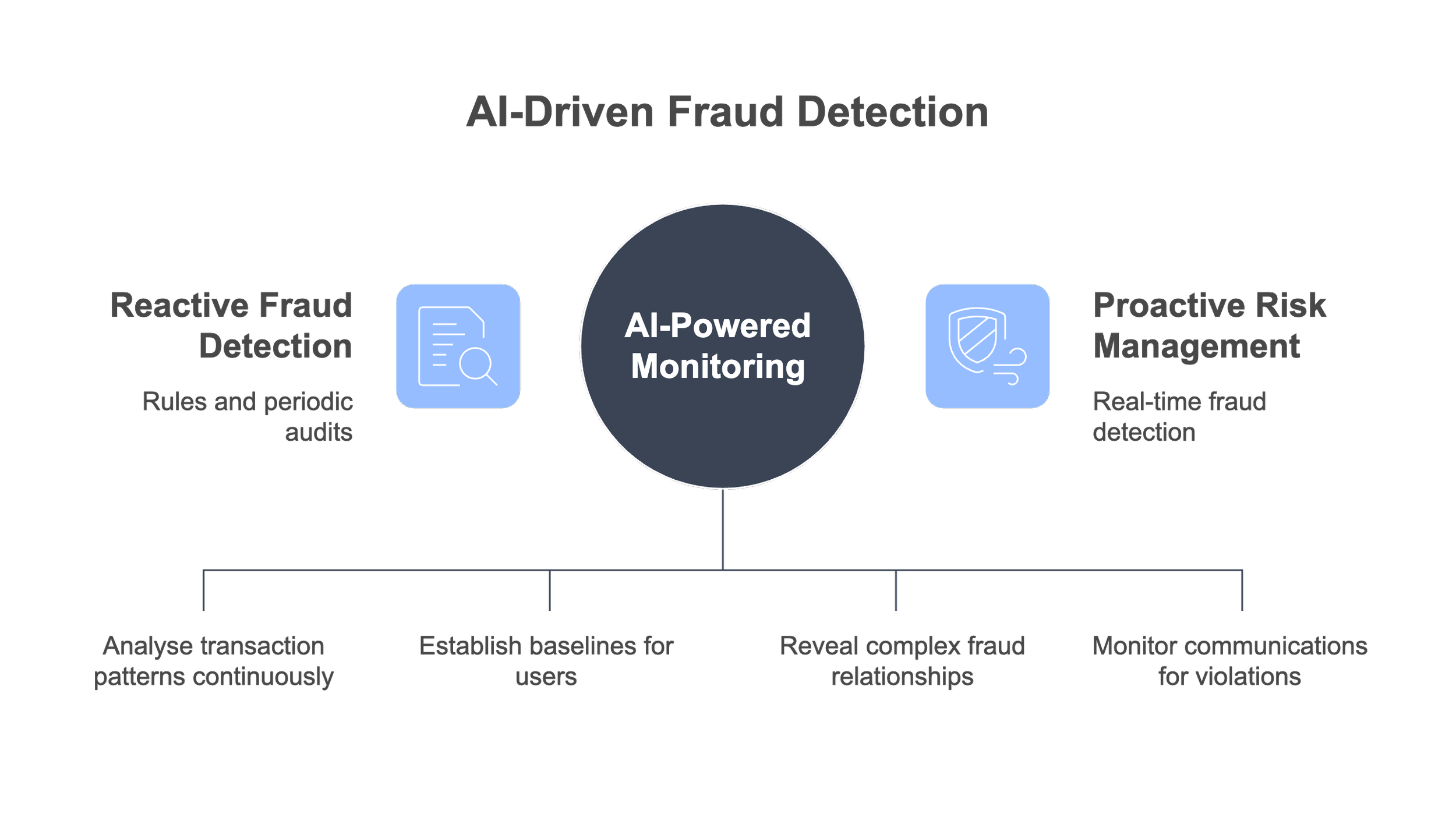

Real-time Fraud Detection and Financial Risk Monitoring

Advanced analytics continuously monitor financial transactions and patterns to identify suspicious activities, potential fraud, and emerging financial risks before they impact the organisation.

CHALLENGE WITHOUT AI

Traditional fraud detection relies on predetermined rules and periodic audits, making it reactive rather than proactive whilst manual risk monitoring cannot keep pace with transaction volumes.

AI SOLUTION OPPORTUNITY

Machine learning algorithms analyse transaction patterns, user behaviours, and system activities in real-time to identify anomalies whilst behavioural analytics establish baseline patterns continuously.

IMPACTED CAPABILITIES

Risk Management, Internal Controls, Compliance Management, Treasury Operations, Financial Reporting, Audit and Assurance capabilities are enhanced through intelligent monitoring and detection.

TANGIBLE BUSINESS BENEFITS

Fraud prevention: Reduction in false positive alerts whilst detecting more actual fraud cases and improving mean time to detection significantly limits potential financial losses.

Risk management: Automated risk monitoring reduces audit costs whilst strengthening control frameworks and providing board-level dashboards with immediate visibility into financial risk exposure.

Compliance enhancement: Real-time monitoring capabilities ensure regulatory compliance whilst reducing manual oversight and improving detection accuracy across all financial processes.

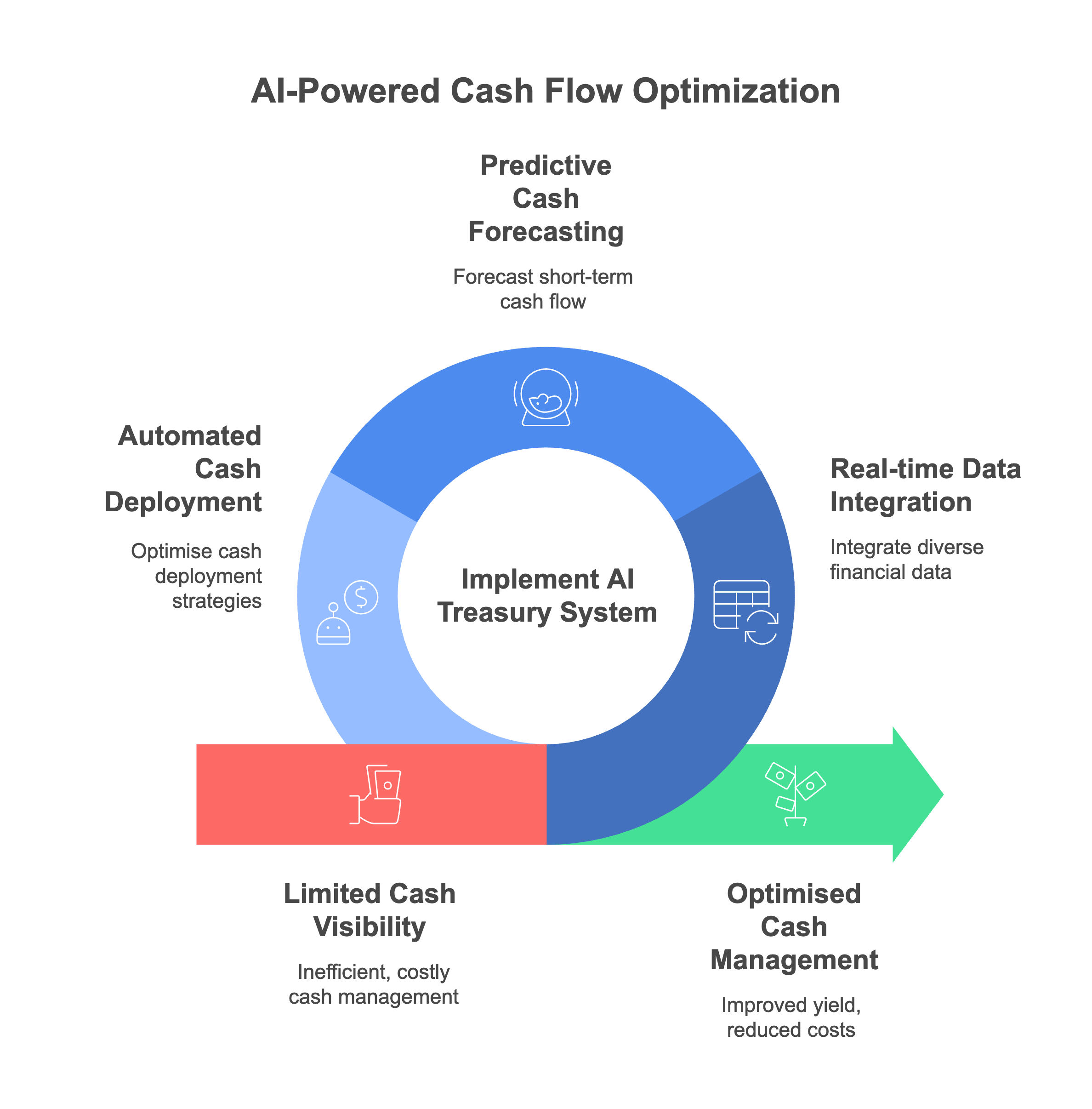

Intelligent Cash Flow and Liquidity Management

AI-powered treasury management systems provide real-time cash position visibility and predictive analytics to optimise liquidity, reduce borrowing costs, and enhance investment returns.

CHALLENGE WITHOUT AI

Traditional cash management relies on periodic reconciliation and static forecasts that provide limited visibility into real-time cash positions whilst manual processes result in suboptimal returns.

AI SOLUTION OPPORTUNITY

Machine learning models integrate bank feeds, accounts receivable, payable, and operational data to provide real-time cash visibility whilst optimisation algorithms recommend optimal deployment strategies.

IMPACTED CAPABILITIES

Treasury Management, Cash Management, Investment Management, Risk Management, Financial Planning, Banking and Financial Institution Management capabilities are enhanced through intelligent optimisation.

TANGIBLE BUSINESS BENEFITS

Cash optimisation: Improvement in cash yield through better optimisation of idle balances whilst borrowing costs decrease through more accurate forecasting and proactive debt management.

Liquidity management: Real-time visibility enables intraday liquidity management, reducing banking fees and improving financial flexibility whilst maintaining appropriate liquidity security.

Capital efficiency: Reduction in average cash balances whilst maintaining liquidity security, freeing capital for strategic investments and improving overall financial performance.

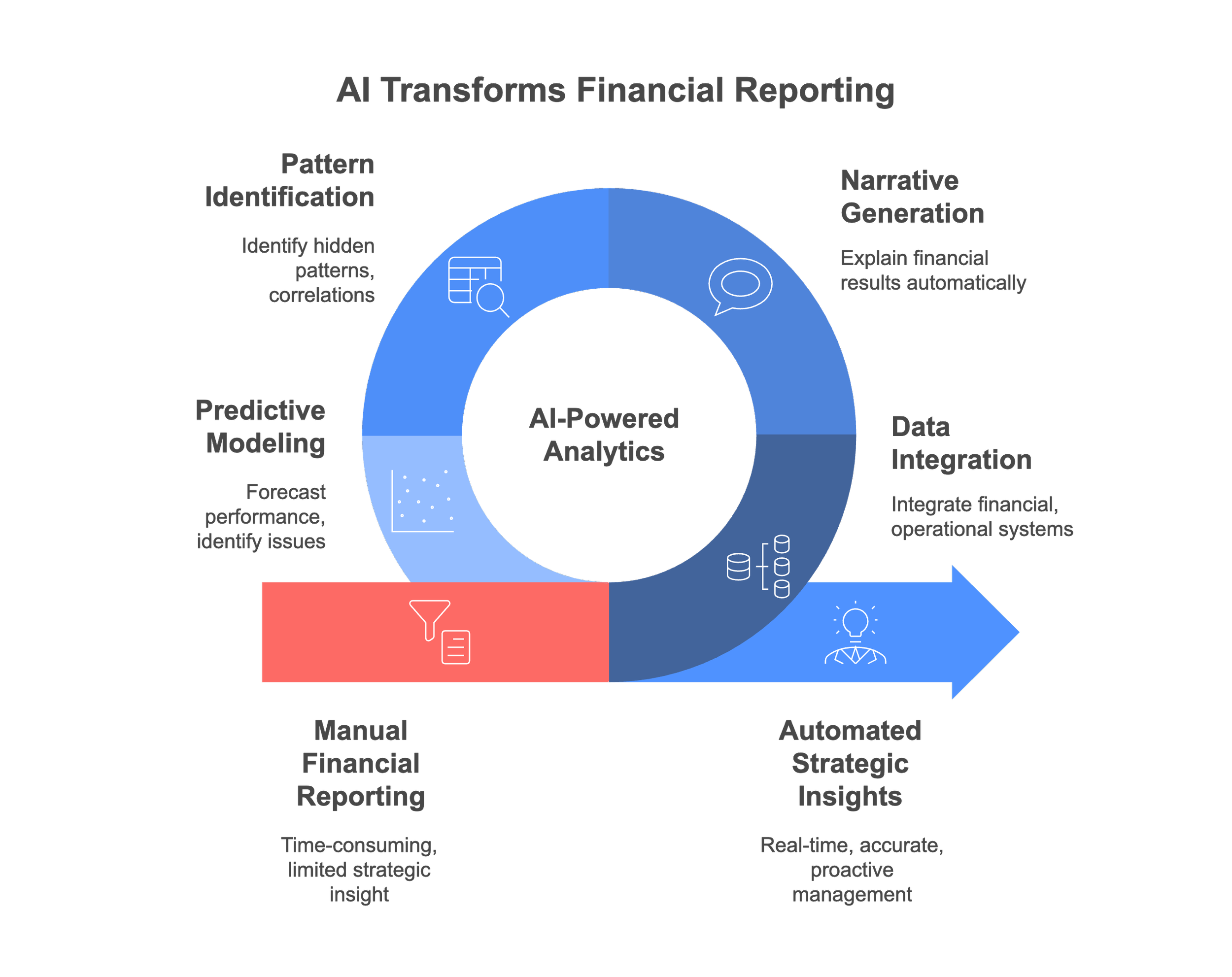

AI-Enhanced Financial Analytics and Performance Reporting

Intelligent analytics platforms automatically generate insights, identify trends, and produce narrative explanations of financial performance, transforming raw data into actionable business intelligence.

CHALLENGE WITHOUT AI

Financial reporting and analysis consume significant resources to produce backward-looking reports whilst analysts spend most time gathering data rather than providing strategic recommendations.

AI SOLUTION OPPORTUNITY

Advanced analytics engines automatically integrate data from multiple systems whilst natural language generation produces narrative explanations and machine learning algorithms identify patterns automatically.

IMPACTED CAPABILITIES

Financial Reporting, Performance Management, Business Intelligence, Financial Analysis, Management Reporting, Strategic Planning capabilities are enhanced through automated insights and intelligent analysis.

TANGIBLE BUSINESS BENEFITS

Reporting efficiency: Report preparation time reduces significantly whilst improving report accuracy and timeliness, enabling senior executives to receive automated insights and recommendations.

Performance monitoring: Real-time performance monitoring enables proactive management intervention whilst improving overall business performance through integrated analytics connecting financial outcomes to business drivers.

Strategic value: Finance teams redirect time from administrative tasks to strategic initiatives that drive business value and employee engagement through enhanced analytical capabilities.

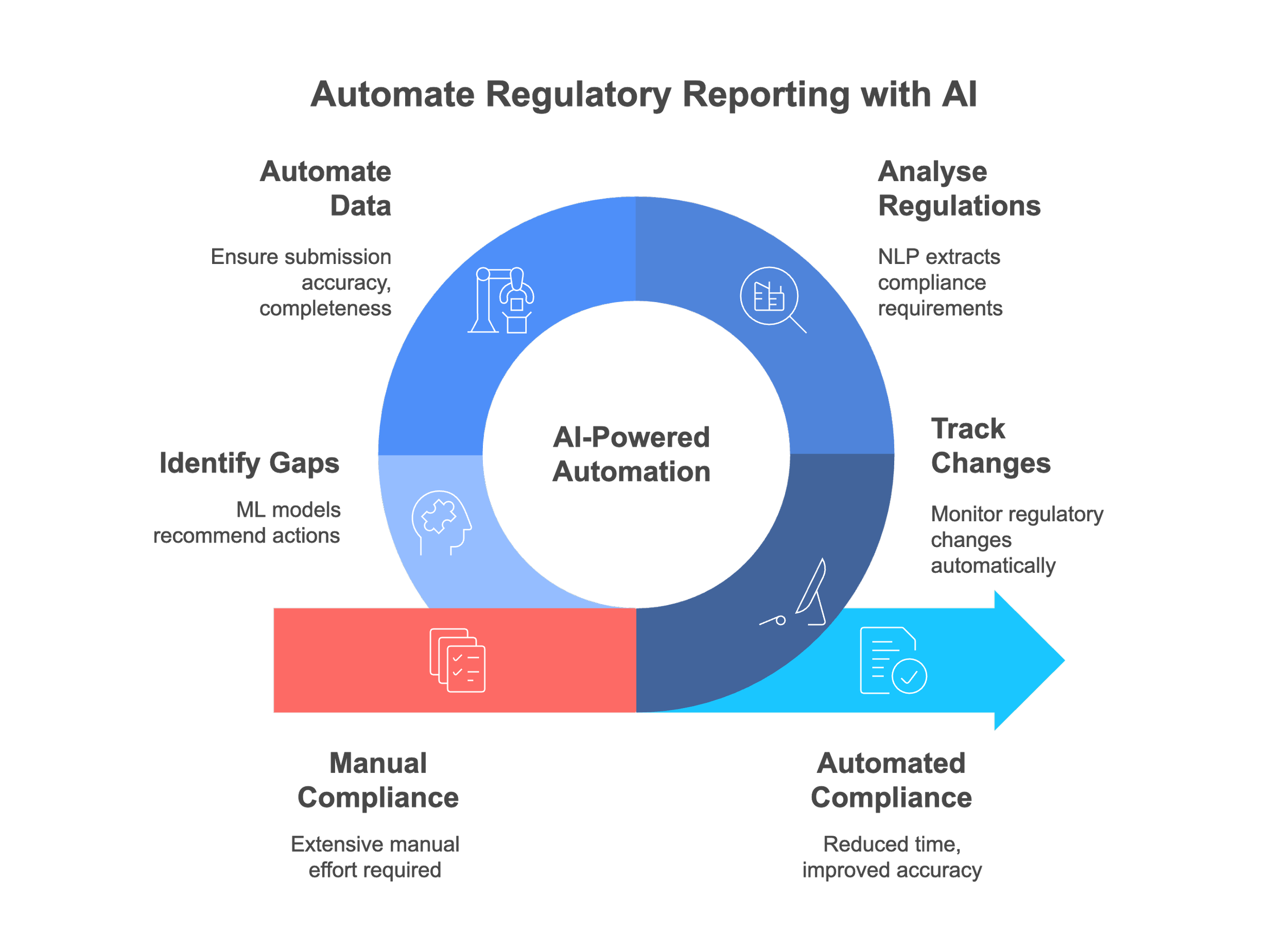

Automated Regulatory Reporting and Compliance Management

AI-powered compliance systems automatically track regulatory changes, prepare required filings, and ensure adherence to financial regulations across multiple jurisdictions and reporting frameworks.

CHALLENGE WITHOUT AI

Regulatory compliance requires extensive manual effort whilst the complexity and frequency of requirements continue to increase, straining finance resources and creating compliance risks.

AI SOLUTION OPPORTUNITY

Intelligent monitoring systems track regulatory changes across multiple jurisdictions whilst natural language processing analyses regulatory texts to extract specific compliance requirements automatically.

IMPACTED CAPABILITIES

Regulatory Compliance, Financial Reporting, Risk Management, Legal and Regulatory Affairs, Audit and Assurance, Data Management capabilities are enhanced through automated monitoring and reporting.

TANGIBLE BUSINESS BENEFITS

Compliance efficiency: Reduction in compliance preparation time whilst improving accuracy and reducing risk of late filings or penalties through automated regulatory change monitoring.

Risk reduction: Enhanced audit trails and documentation quality strengthen relationships with regulators whilst finance teams reallocate compliance-related effort toward strategic analysis.

Process improvement: Automated regulatory change monitoring ensures timely awareness of new requirements whilst reducing compliance surprises and improving overall regulatory relationships.